Our travel policy does not cover pre-existing medical conditions as standard. We offer a confidential, independent medical screening service to provide a top-up if you need cover for a pre-existing medical condition. Contact their helpline at + 44(0)1702 427 237.

After answering questions about your medical conditions, the screening service will confirm if they can cover them. They may need to charge a premium, and they will explain any additional requirements, such as an increased excess.

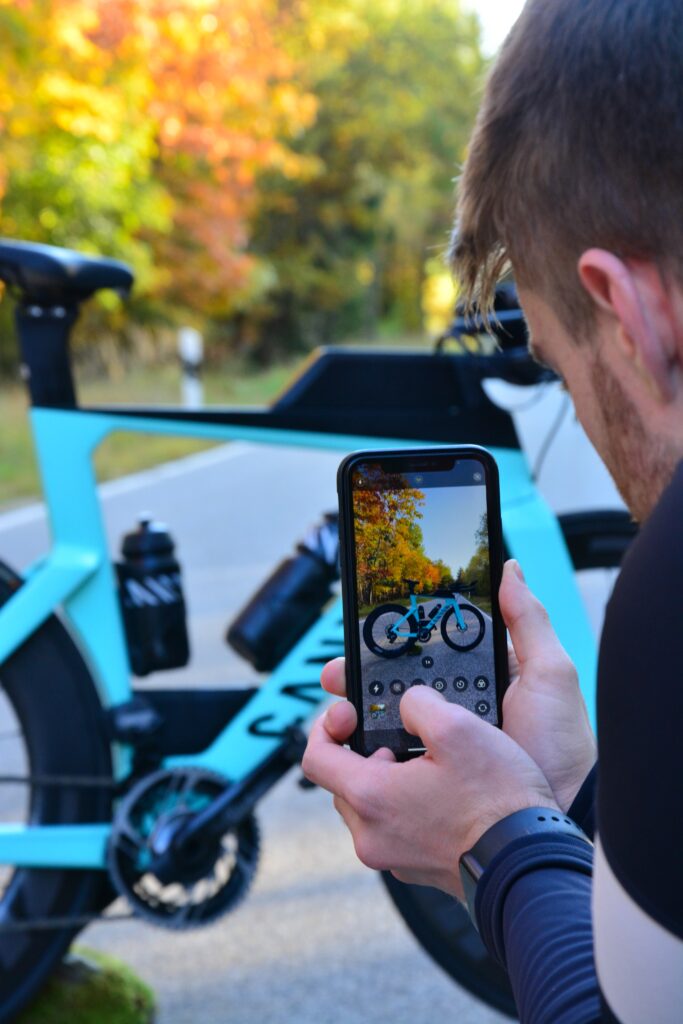

If the helpline can provide the additional coverage and you elect to purchase it, you must first buy our Pedal Cover cycling travel policy. You will supply the helpline with your Pedal Cover policy number. You will pay any premium for the additional cover directly to the screening helpline, not Pedal Cover.

Once the medical conditions are covered, the helpline will give you a screening reference number. The helpline will send a letter confirming cover, cost, and requirements. Please keep this safe as it is required in the event of a claim.

If you purchase our Pedal Cover triathlon travel insurance before speaking to the medical screening helpline, and subsequently, they cannot offer a top-up, or you are unhappy with the extra cost quoted, you can cancel your travel insurance with us. We will provide a complete, no-quibble refund within the first 14 days of purchase.