How to Start Bikepacking: The Complete Beginner’s Guide

There’s something special about exploring the outdoors by bike—combining the freedom of cycling with the adventure of camping. Bikepacking has

One quick quote. Three ways to cover your bikes — bike-only insurance, home contents cover, or buildings & contents cover, all designed exclusively for cyclists.

From commuters to climbers, cyclists don’t all need the same type of cover. The right option depends on how you ride, what you own, and how much of your life revolves around cycling. That’s why Pedal Cover offers three bespoke solutions — all built exclusively for cyclists.

One quote. Three ways to cover your bikes — ride your preferred route.

Your quote compares three tailored solutions. Depending on the route you choose, specialist cycle cover can include:

Comprehensive home insurance designed for cycling households, covering your property and specialist cycle cover built in as standard.

Live in a flat or rent your property? We offer contents insurance designed to protect bikes, accessories, and cycling kit properly at home.

Flexible monthly cover for theft, accidental damage, liability, and riding — with a wide range of optional extras, backed by cyclist-led claims expertise.

Because we only insure cyclists, our claims are handled by people who understand bikes.

Our claims team includes former bike mechanics and cycling industry specialists, not generalist call centres. They know components, specifications and real-world replacement values — which means fewer disputes, faster decisions, and better outcomes for cyclists.

We even hold key bike parts in-house to reduce repair delays and get riders back on the road as quickly as possible.

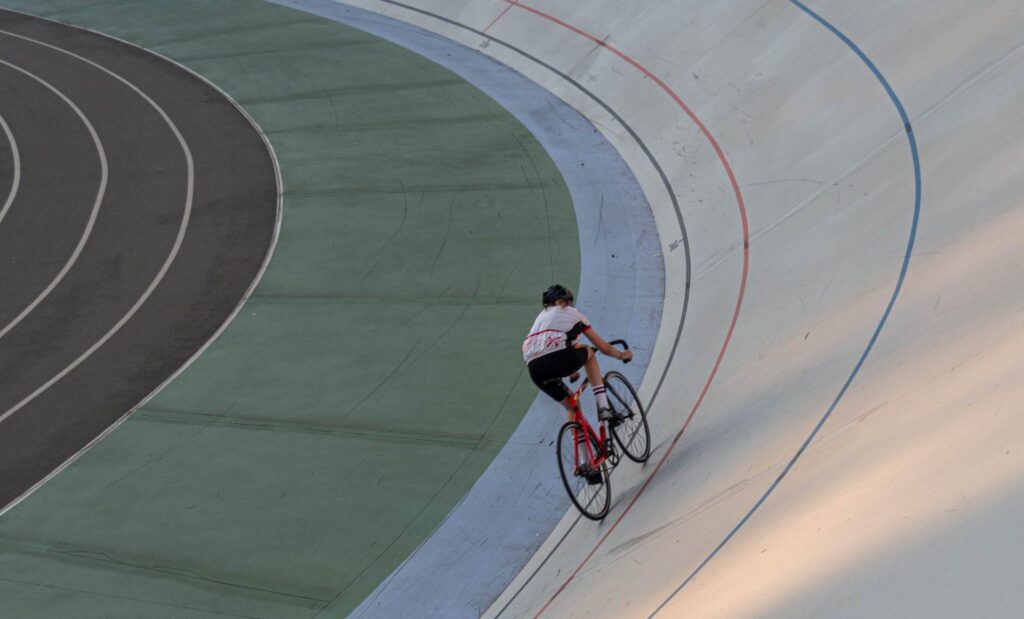

Cycle Travel insurance is designed specifically for cyclists heading overseas to train, ride, or compete — with medical and trip protection built around cycling as the main purpose of travel.

This cover is separate from bike and home insurance, and applies when cycling is the reason you’re travelling abroad, not just something you do while you’re away.

There’s something special about exploring the outdoors by bike—combining the freedom of cycling with the adventure of camping. Bikepacking has

The term VO2 max is often mentioned in cycling circles and media, usually describing short, hard efforts or referencing “huge”

Whether you’re aiming for your first sprint triathlon or targeting a long-distance event, a well-structured training plan is essential for

Scotland is a dream destination for mountain bikers, offering everything from technical forest descents to sweeping ridge rides. After spending

0800 121 4424

Mon-Fri 9-5pm