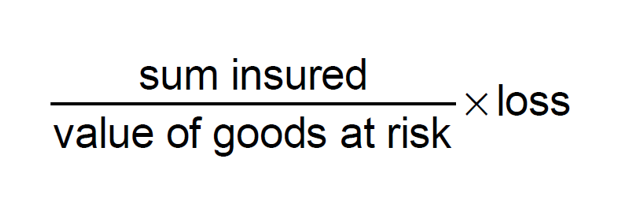

Our policies are designed and priced to cover your whole bicycle so it is very important that you insure your bicycle for its full value. You cannot insure part of the value of your bicycle in order to reduce your premium. If you under-insure your bicycle, our claims handlers may apply a “proportional reduction” to your settlement. In short, saving a few pounds on a premium now could ultimately cost you far more in the long run. In this article, we are going to explain the importance of valuing your bicycle and how if you don’t get it right, your claim can be affected.

Can’t I just insure my bike for what I want?

NO!! A common myth of any type of insurance is that you can simply insure an item you own for a value which you would accept in the event of a claim. For example, insuring a £4,000 bike for £2,000 in the hope that if you damaged the bike, provided that the claim was under £2,000, you’d be covered. This is a classic case of underinsurance and one where customers are often surprised with a claim result.

How does underinsurance work?

If your bicycle is worth £4,000 but you only value it at £2,000 on your policy, you are 50% underinsured. If you were to make a claim, our policy would only pay 50% of your claim. This means you would have to pay the rest yourself. This is applies to bicycles which are classed as a total loss (e.g, stolen or not economical to repair) and also cases whereby only a small proportion of the total bicycle value is damaged, for example a brake lever.

Can you show me some real world examples?

Example 1:

Bicycle value £6,000. Insured value £3,000, claim value £1,000.

This person decided to insure their £6,000 bicycle for half of its value. Their reasoning was that if at least half of the bicycles value was covered, then the chances were that bar a total loss, £3,000 would be adequate to cover the cost of replacing any damaged components. As the bicycle was 50% under insured, the claim value was proportionally reduced so the client was paid out £500 less their excess.

Example 2:

Bicycle value £1,000, insured value £800. Claim value-total loss as the bicycle was stolen.

In the above example, the insured wanted to save some money on their policy so only insured 80% of the bicycles value. When the insured submitted their claim, as only 80% of the bicycles value was insured, we could only agree to pay 80% of the claim. Sadly, this meant that for the client to replace their bicycle, they had to pay an additional £200 for their replacement bicycle. The reality was that the £8 saving they made by under insuring the bicycle turned into an additional cost of £200 when they came to claim.

Example 3:

Bicycle value £3,000. Insured value £1,000, claim value- total loss to £1,000 wheelset.

This client thought that they would only insure the cost of the most expensive component. The claim was for a damaged wheelset which their receipt showed they paid £1000. The client’s excess was £100 and they wanted us to cash settle, as opposed to replace. This meant that in order for us to cash settle for the wheelset, the client was only paid £233.33 (The bicycle was only 1/3 insured so only 1/3 was paid out)

How do I avoid underinsurance?

Easy! To avoid underinsurance, simply insure your cycling equipment for the price you paid for it, rather than the current market value. If you have made any upgrades or modifications to your equipment, you must include these costs when insuring.

If you’re unsure about the value of your bike and whether you’re adequately insured, it’s important to seek further assistance from us. Our support team can help you assess the value of your bike and ensure that you’re fully covered. Don’t take any chances when it comes to your bike – make sure that you’re fully protected with the right level of insurance coverage!

What about the contents of my home?

Underinsurance can also be applied to your general contents. To avoid the risk of being underinsured, it’s worth spending a bit of time tallying up the exact value of all your worldly goods to ensure you get an appropriate insurance cover. To help you calculate the value of your contents, many simple-to-use home contents calculators should help give you an accurate idea of the total value of your possessions.

A common misconception is that an insurer’s quoted level of cover will cover possessions up to that value, regardless of the total value of the possessions, which is not the case. For example, if a policy provides home contents cover of up to £75,000 but the total value of your contents is more like £100,000, this doesn’t mean that in the event of claims up to £75,000, you’ll receive the total amount. An insurer would likely apply an “average clause” based on the level of underinsurance. If the claim is for, say, £40,000, the insurer would only pay out £30,000 based on the quoted value of your contents being 75% of the actual value. in a worst case scenario, an insurer may decline the claim in its entirety and refund your premium paid. It therefore makes sense to have insurance cover for the true value of your possessions – if you have £100,000 worth of contents, make sure your policy covers it.

If you would like to discuss your insurance needs or better understand how to calculate the value of your possessions, including your bikes, drop us a line, and we’ll be happy to help.

Top tips to avoid bicycle underinsurance

- Always insure your bike for the price paid

- Include the value of upgraded parts on top of the original purchase price

- If you use a power meter on multiple bicycles, you must ensure that it’s value is included on your most expensive bicycle

- Pedalcover do not devalue your bicycle based on its age or condition. Do not insure your bicycle for what you think its currently worth.

- If in doubt, call us on 0800 121 4424