No, you only need to list valuables that you want insuring under this policy.

Pedal Cover is a unique cycle insurance specialist based in the Vale of Glamorgan. Our combined home and cycle insurance product was launched in 2014, and it was developed by former professional cyclist Darren Thomas. Since then, we have continued to innovate and introduce new products, such as our monthly dedicated cycle insurance. Currently, we insure over £50 million worth of bikes and are committed to expanding our offerings to cater to our clients’ needs and lifestyles.

We are proud to have received numerous industry awards for our fresh approach to insuring cyclists. Additionally, we sponsor some of cycling’s biggest organisations in Wales and the UK. We owe a big thank you to our community of clients, fellow cyclists, and staff for joining us on this incredible journey, and we hope to continue working together to achieve great things.

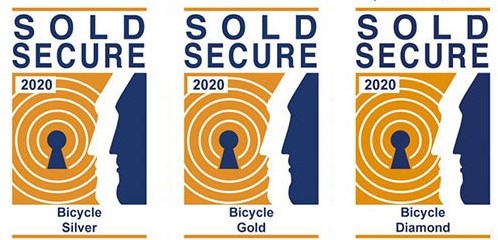

Below are some of the awards we have received and partners we work with: